We know everybody’s affairs are very different, that’s why i work on home loans who are experts in all different home loan subjects.

If you wish to borrow a large amount of money quickly, perhaps purchasing an auction property or their client within the a great chain keeps dropped out, a connecting financing could possibly be the proper service on these types away from products.

Typical bridging financing can cost you can be hugely high, however, because they include various relevant charges. This short article establish exactly what charges to look out for, and exactly how a broker makes it possible to get the very prices active solution.

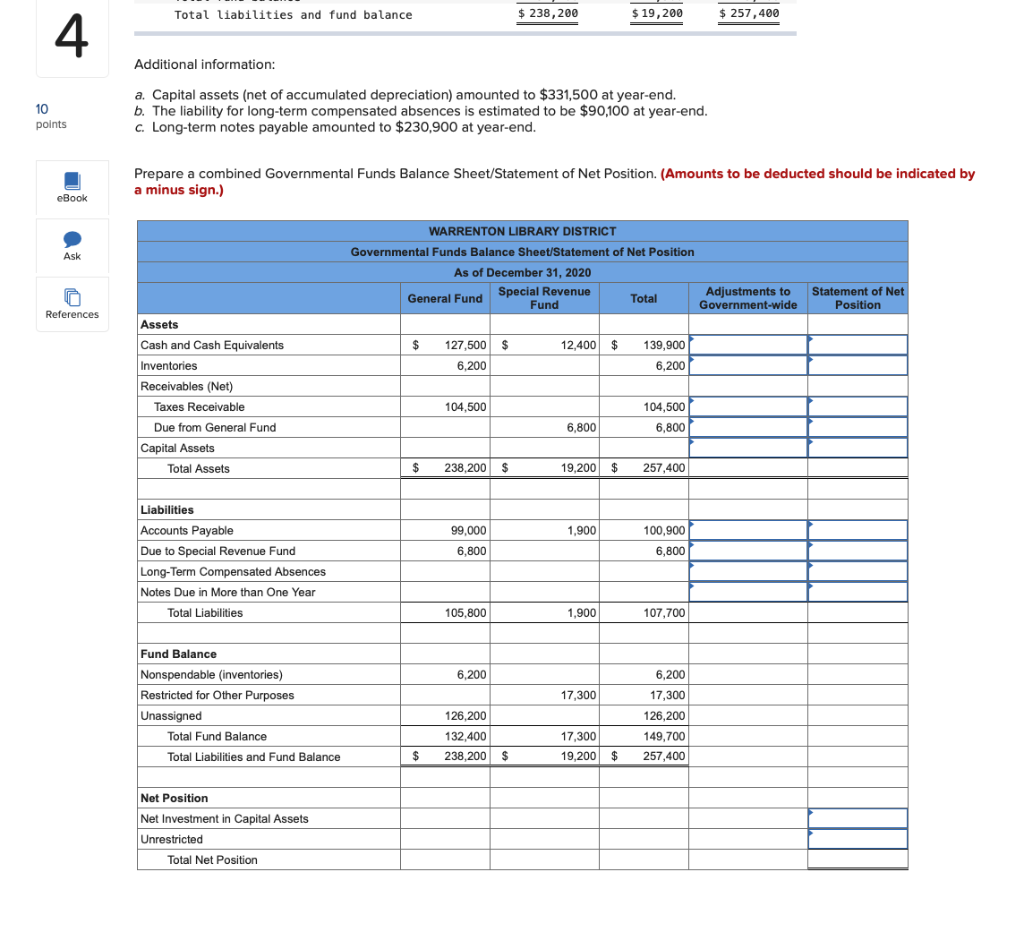

- Precisely what does a connecting mortgage prices?

- Fees can be expected

- Simply how much attract will you pay?

- How to get an affordable connecting mortgage

- Things to consider while you are to invest in a house

- Rating matched having a bridging mortgage agent

The biggest activities affecting the expenses a part of these money is the interest rate and title, that can cost you can differ based on if you would like a beneficial bridging mortgage to possess property purchase, to acquire belongings and industrial objectives.

Connecting loan terms can be as brief since the three to six weeks, even if you can use bridging financing for as long as twenty four otherwise 36 months. New offered you borrow the mortgage having, the greater number of might shell out full.

Although not, as outlined below, there are other charge available. Your individual facts plus the construction of your bridging mortgage can get together with impact the cost. For this reason it’s informed to dicuss in order to a brokerage proficient in connecting finance get redirected here to aid assist you through the process.

Unit costs

Nearly all connecting loan companies have a tendency to cost you something fee (referred to as a plan percentage or business percentage) having organising your loan. The cost may be a percentage of one’s amount you are borrowing. It will start around step one.5% and you will step 3%, it is always dos%. So if you needed to acquire ?100,100, the item percentage might be ?2000.

Whenever you are borrowing an extremely high amount of money, the lender may charge a reduced unit payment, or waive the fresh new charges altogether.

Broker charges

When you you can expect to approach a loan provider in person, it is told to partner with a bridging loan representative who makes it possible to find the right offer, discuss for you and you will handle the fresh state-of-the-art documentation.

The latest broker’s percentage ount you need to obtain, that will range between 0.5% in order to 2%, otherwise it could be a flat rate.

It’s always best to end agents recharging highest initial costs, and you may as an alternative run an agent which costs toward a success-merely base, definition you can just need to spend once they efficiently organise your own loan.

Deposit

Try to set out some money due to the fact a deposit on your property. The bigger their put, the low the pace you are going to charge.

Very connecting money tend to anticipate that shell out a deposit regarding about twenty-five% of your property’s well worth, meaning the mortgage covers the rest 75% of costs to order the home, but some individuals commonly lend doing 80% or 85% loan-to-well worth (LTV).

You can easily score a connecting financing for one hundred% regarding an effective property’s worthy of, however, constantly the second property that the borrower owns is used due to the fact coverage on the financing.

Valuation survey charges

Connecting loan lenders would like to test the house or property, observe it is really worth the count you ought to borrow and that it is during great condition however, if they need to repossess it and sell they by themselves for folks who fail to keep track money.